Have been perusing that

amended civil complaint a bit this morning.

Like PokerStars and UB/Absolute Poker, Full Tilt Poker was accused in April of violating the Unlawful Internet Gambling Enforcement Act, bank fraud, and money laundering. Now the DOJ’s amendment to the civil complaint, besides adding Howard Lederer, Chris Ferguson, and Rafe Furst to those being accused, adds a few other major allegations as well, including...

(1) that the company’s manner of crediting accounts without first securing those deposits plunged the company into serious financial trouble;

(2) that the owners were skimming from players’ funds in a major way, thus further accelerating the company’s progress down that road to ruin; and

(3) that all along the way the company was inaccurately telling players everything was hunky dory.

Looking at these separately...

(1) “Phantom Money”

That first item is mentioned early on in the amended complaint when the DOJ explains how “Full Tilt Poker’s payment processing channels were so disrupted that the company faced increasing difficulty to collect funds from players in the United States,” and thus made the grievous decision to begin crediting accounts without finalizing transactions.

The complaint estimates the site did this to the tune of about $130 million worth of so-called “phantom money,” funds that appeared on the site between the summer of 2010 and April 2011.

I read a piece yesterday over at the Reason site arguing that “

The Government Blames Full Tilt Poker for the Disruption the Government Deliberately Created.”

The author, Jacob Sullum, makes a couple of good points in the piece. Alluding to what has surely been the most-quoted line this week regarding the DOJ’s action, the one from U.S. Attorney Preet Bharara (in

the press release) stating that “Full Tilt was not a legitimate poker company, but a global Ponzi scheme,” Sullum correctly points out that in Bharara’s eyes, there is probably no such thing as a “legitimate poker company” operating online and serving U.S. players.

I thought the exact same thing when I first read Bharara’s statement. That never mind the “Ponzi scheme” stuff... what the heck does he mean by a “legitimate poker company”?

Sullum also points out how by passing the UIGEA, “it was the U.S. government, of course, that deliberately disrupted Full Tilt Poker's payment processing network in the United States in the name of preventing Americans from playing online poker.” Again, that is eminently the case. If not for the UIGEA, the site’s payment processing channels would likely not have been “so disrupted.”

But from there Sullum draws the odd conclusion that “the government created the very situation it is now blaming on Full Tilt Poker.” Which makes no sense.

Full Tilt Poker is being accused of a host of blameworthy offenses, none of which are “the situation” created by the passage of the UIGEA. Some of those offenses may well have never been committed had not the UIGEA been passed. But it’s silly to say the DOJ is blaming Full Tilt Poker for the “disruption” because it’s not. And it’s also silly to suggest that when it comes these other allegations -- of owners’ skimming funds or the site’s deliberately misleading communications to players -- that culpability can somehow be transferred away from Full Tilt Poker and rested at the feet of the U.S. government.

(2) “FTP Insider Accounts”

The amended complaint includes some remarkably precise details, obviously obtained by the DOJ from someone inside of Full Tilt Poker. These details include information that helps to measure just how deep the doo-doo was in which FTP found itself as well as the extent to which the owners were apparently funneling money at a rapid clip into their own “FTP Insider Accounts.”

We learn that “according to a balance sheet prepared by Full Tilt Poker, as of March 31, 2011, Full Tilt Poker owed players from around the world over approximately $390,695,788 but had only approximately $59,579,413 in its bank accounts.”

We also find details about how much “Defendant Bitar,” “Defendant Lederer,” “Defendant Ferguson,” and “Defendant Furst” each allegedly received into their personal accounts between April 2007 and April 2011, an amount totaling about $120 million, with about $60 million more “allocated” to Ferguson though not paid.

“The other approximately 19 owners of Tiltware LLC” are said to have received the rest of the $443,860,529.89, including one unnamed owner (“Player Owner 1”) who received about $40 million plus another $4.4 million in “loans,” a person many have surmised must be Phil Ivey.

These are all just allegations, of course. Rafe Furst, one of those named in the amended complaint,

has already denied any wrongdoing. Other Team Full Tilters who might be among the “approximately 19” who could be considered “owners” have made statements as well, including

Tom Dwan and

Gus Hansen.

And Ferguson’s lawyer, while not denying the specific charges against his client,

issued a statement yesterday decrying Bharara’s use of the term “Ponzi scheme” to describe Full Tilt Poker, claiming the characterization is both inaccurate and “inflammatory... in the post-Madoff era,” and thus “may violate pre-trial publicity rules of professional responsibility.”

Whatever you want to call it, should these allegations prove true they certainly suggest some pretty serious culpability. And while I suppose one could argue that if it weren’t for the UIGEA there wouldn’t be a need to be moving funds around like this -- including into personal accounts -- it looks pretty bad, regardless.

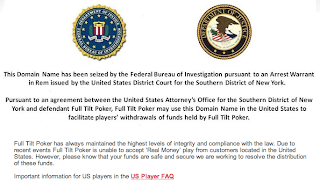

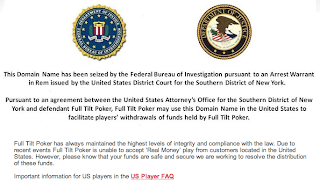

(3) “Please Know That Your Funds Are Safe and Secure”

Here’s where I think the average Full Tilt Poker player gathers most of his or her outrage -- from those statements by the company, repeated

ad infinitum, that funds were “safe and secure.”

The amendment compiles a bunch of examples of such statements made between 2008 and 2011, although most of us are already familiar with them via our email inboxes, Two Plus Two, or simply visiting the fulltiltpoker.com website.

We read how in May 2008, Full Tilt Poker was emailing customers saying “we would like to assure you that your money is not at all at risk and there is no poker site on the Internet where your money would be any safer than at Full Tilt Poker.”

Think back to the summer of 2008. When one site told you then that your money was safer with them than with all other sites, which of those other sites would have sprung to mind? The ones where “super-users” and cheating occurred, right? Over which the poker community was split regarding whether or not one should feel safe when playing. The fact was, in such an environment, reassurances that Full Tilt Poker was no UB or Absolute Poker had some effect.

Along the same lines, the complaint quotes another boilerplate sent out around the same time in which the company pointed out that “unlike some companies in our industry, we completely understand and accept that your account money belongs to you, not Full Tilt Poker.”

Then come more specific assurances regarding the segregation of funds, such as “FTPDoug”’s July 2008 contribution to

a thread on Two Plus Two (referred to generically in the amended complaint as the “Poker Forum”) in which he responds to posters’ apprehensions about the site's using players' funds for operational expenses. “I can say with authority,”

writes FTPDoug, “that we do not mix deposits with operational expenses.”

Again in

another thread, this one begun in June 2009, concerning the seizure of funds from a payment processor,

FTPDoug chimes in “to reassure everyone that your funds remain safe and secure at FTP.... We always make sure we can cash out any of our players at any time. You should never have to worry that you won't get your money, and we’re doing everything we can to ensure you always have plenty of methods available for both deposits and withdrawals.”

Full Tilt made similar claims to the Alderney Gambling Control Commission apparently, too. The amended complaint quotes from a document (no date is given) in which the site ensured its licenser that “[a]ll players have an account that holds money that is available to them on the Full Tilt Poker system,” that “[t]he player may withdraw funds up to the current balance of their account at any time, subject to any applicable bonus terms and conditions,” and that “[n]o play may commence unless the player has credited his account with cleared funds and has adequate funds to participate in the selected game.”

Such was certainly not the case starting some time in 2010, if not before.

Then, in response to Black Friday, came a “Statement from Full Tilt Poker Regarding Recent Check Withdrawal Issues.” “In light of recent events involving the freezing of certain accounts,” the statement goes, “Full Tilt Poker would like to assure all players that their funds remain safe and secure. Processing of both deposit and withdrawal requests is proceeding as normal and is still available to all of our players.”

As noted above, this came a couple a weeks

after that internal balance sheet was showing Full Tilt Poker owing its players about $390 million while only having a little under $60 million in its accounts.

And apparently it got even worse rather quickly, as another communication, this one an email sent by Ray Bitar on June 12, 2011, noted how “at this point we can’t even take a five million run” should players suddenly begin withdrawing.

The complaint also notes -- sort of like a weak, almost obvious punch-line -- how “As of September 19, 2011, Full Tilt Poker’s website stated that players’ funds were ‘safe and secure.’” Indeed, that line continues to appear on the site today.

There was clearly a moment, one that came well before Black Friday, when Full Tilt Poker knew it was operating in a way that could not be sustained indefinitely. In other words, even if it didn’t exactly match the criteria some would require to call it a “Ponzi scheme,” it was like a Ponzi scheme insofar as it was destined to fail.

What’s next for Full Tilt Poker? The amended complaint outlines its argument for forfeiture -- i.e., when it comes to whatever is left of the company’s assets, the government wants whatever it can get.

F-Train and

Chops (in that podcast

I was referring to yesterday) speculated about a possible “widening of the net” by the DOJ to include other yet-to-be-named individuals. And there’s that still ongoing hearing with the Alderney Gambling Control Commission, where rumors about possible investors continue to swirl.

Who knows, really? There will surely be more drama, but from the perspective of most who played on the site, it appears the damage has been done.

The players sponsored by Full Tilt were called “red pros.” The innocent among them are now red with embarrassment and/or anger. Those less so are being colored red as well as a symbolic reference to their guilt. And, of course, the whole dang outfit is deep in the red, now, too.

Labels: *the rumble, Black Friday, Chris Ferguson, Full Tilt Poker, Howard Lederer, Preet Bharara, Rafe Furst, Ray Bitar, UIGEA

Ended yesterday’s post with that pic of the Full Tilt Poker zombie, coming for our brains. Was intending to refer more to the story of FTP than FTP itself, a story that just... keeps... heaving forward... step by staggering step.

Ended yesterday’s post with that pic of the Full Tilt Poker zombie, coming for our brains. Was intending to refer more to the story of FTP than FTP itself, a story that just... keeps... heaving forward... step by staggering step.